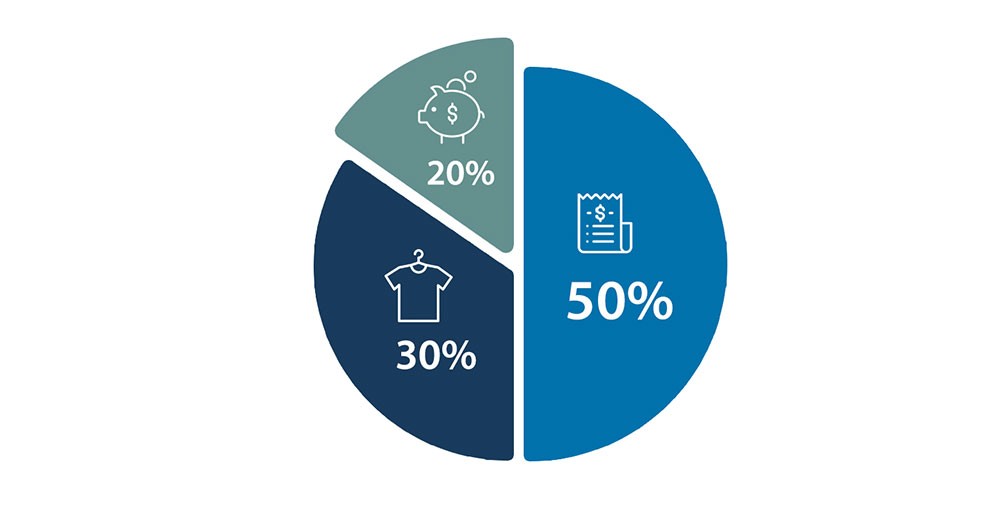

Managing money doesn’t have to feel overwhelming or complicated. The 50/30/20 rule has emerged as one of the most effective and straightforward budgeting strategies for people seeking financial clarity and control. This time-tested approach divides your after-tax income into three distinct categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

What makes this budgeting method so appealing is its simplicity and flexibility. Unlike complex financial plans that require extensive tracking and calculations, the 50/30/20 rule provides a clear framework that anyone can implement immediately. Whether you’re a recent graduate starting your first job, a family looking to optimize spending, or someone seeking to regain control of their finances, this rule offers a practical foundation for building lasting financial habits. The beauty lies in its balanced approach—ensuring you cover essential expenses while still allowing room for enjoyment and future security.

Understanding the 50/30/20 Budget Breakdown

The 50% – Essential Needs Category

The largest portion of your budget, 50% of your after-tax income, should cover your essential needs. These are non-negotiable expenses that you must pay to maintain your basic standard of living. This category includes:

-

Housing costs (rent, mortgage, property taxes, utilities)

-

Transportation expenses (car payments, insurance, gas, public transit)

-

Groceries and essential food items

-

Minimum debt payments

-

Health insurance and basic healthcare costs

-

Phone and internet services

If your needs exceed 50% of your income, it’s a signal to evaluate your lifestyle choices. Consider downsizing housing, refinancing loans, or finding ways to reduce fixed expenses.

The 30% – Wants and Lifestyle Spending

This category covers discretionary spending that enhances your quality of life but isn’t essential for survival. The 30% allocation for wants includes:

-

Dining out and entertainment

-

Hobbies and recreational activities

-

Streaming services and subscriptions

-

Clothing beyond basic necessities

-

Travel and vacations

-

Gym memberships and fitness activities

The wants category provides flexibility and prevents your budget from feeling too restrictive. It’s crucial for maintaining motivation and avoiding the deprivation mindset that often leads to budget failures.

The 20% – Savings and Debt Repayment

The final 20% focuses on building your financial future through savings and accelerated debt repayment. This category encompasses:

-

Emergency fund contributions

-

Retirement savings (401k, IRA contributions)

-

Extra debt payments beyond minimums

-

Investment accounts

-

Specific savings goals (house down payment, vacation fund)

This portion is your pathway to financial freedom and security, creating a buffer against unexpected expenses while building long-term wealth.

Benefits of Implementing the 50/30/20 Rule

Simplified Financial Decision-Making

The 50/30/20 rule eliminates decision fatigue by providing clear spending guidelines. Instead of questioning every purchase, you know exactly how much you can allocate to each category. This clarity reduces financial stress and makes budgeting feel more manageable.

Balanced Approach to Money Management

Unlike extreme budgeting methods that focus solely on cutting expenses, this rule maintains balance between present enjoyment and future security. You’re not sacrificing today’s happiness for tomorrow’s goals, nor are you ignoring your financial future for immediate gratification.

Automatic Savings Habit

By allocating 20% to savings and debt repayment from the start, you’re paying yourself first. This approach treats savings as a non-negotiable expense, helping you build wealth consistently over time.

Practical Tips for Success

Track Your Spending Initially

Start by monitoring your expenses for a month to understand your current spending patterns. Use budgeting apps, spreadsheets, or simple pen-and-paper tracking to identify where your money goes.

Adjust Gradually

If your current spending doesn’t align with the 50/30/20 framework, make gradual adjustments rather than dramatic changes. Small, consistent modifications are more sustainable than radical overhauls.

Automate Your Finances

Set up automatic transfers to savings accounts and automatic bill payments to ensure you stick to your budget without constant manual intervention.

Review and Refine Regularly

Your financial situation will evolve, so review your budget quarterly and adjust percentages as needed. Life changes like promotions, new expenses, or debt payoffs may require modifications to your allocation.

The 50/30/20 rule provides a solid foundation for financial success, offering structure without rigidity. By following this framework consistently, you’ll develop healthy money habits that support both your current lifestyle and future financial goals.